nanny tax calculator free

This is a sample calculation based on tax rates for common pay ranges and allowances. This free easy to use payroll calculator will calculate your take home pay.

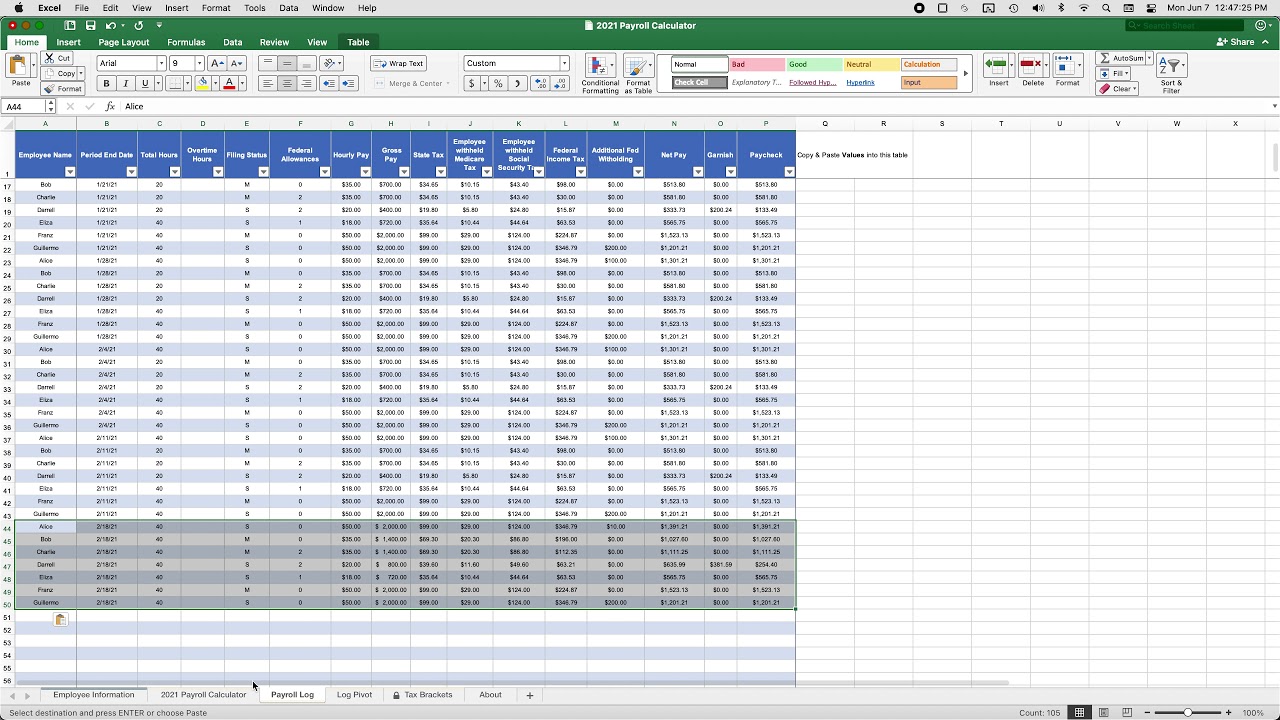

Nanny Tax Diy Payroll Excel Calculator For Small Business Owners Federal Income Tax Withholding Youtube

This year its 62 for Social Security tax and 145 for.

. Calculates Federal FICA Medicare and. Thats less than everyone else charges per. For specific tax advice and guidance please call us toll free at 877-626-6924 and a NannyChex.

However in most situations you need to pay 06 for unemployment insurance for the first 7000 you pay your nanny. Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator. Add up the hours your nanny has worked during the previous payroll period.

Our new address is 110R South. Using a nanny tax calculator. Ive put the tax rates right into this handy spreadsheet above but you can also check the tax rates with the IRS.

This calculator allows you to get an idea of how much you will pay and how much your nanny will take home. Employers need to withhold around 13-20 of their nannys gross wages to pay for the nanny tax. Just 29 a year.

This calculator is intended to provide general payroll estimates only. For tax year 2021 the taxes you file in 2022. The taxes withheld from them.

As for Social Security and Medicare tax. Cost Calculator for Nanny Employers. This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will be updated again.

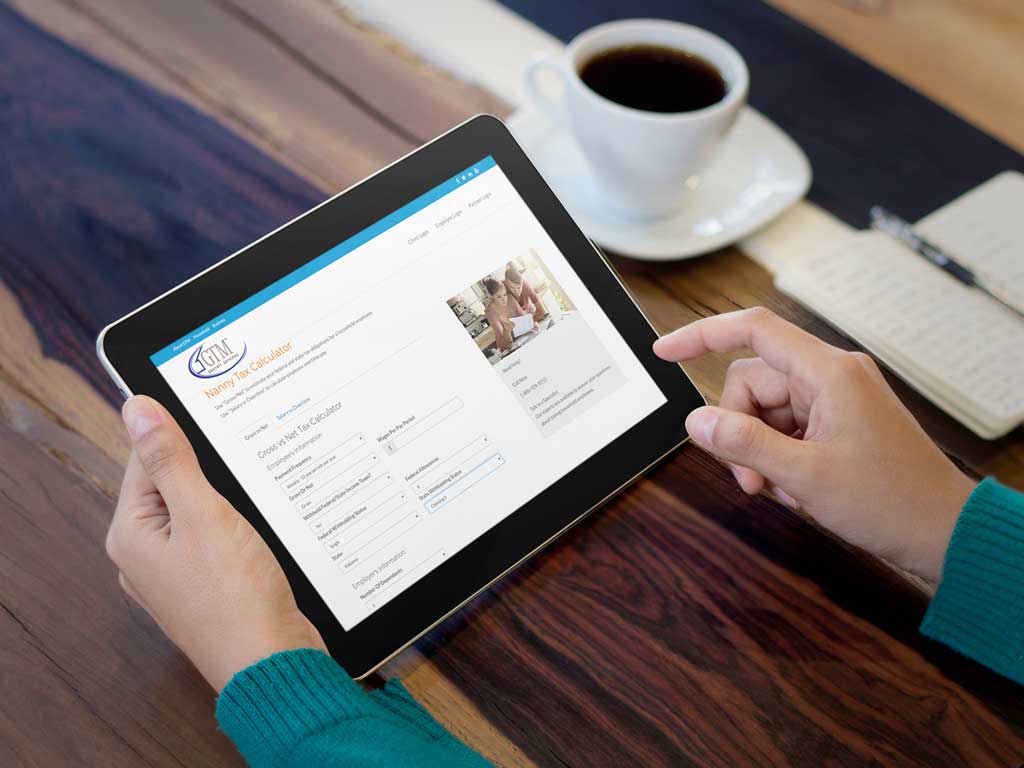

Nanny tax calculator for a nanny share. Supports hourly salary income and multiple pay frequencies. Are you looking for a free nanny tax calculator.

It includes an option of different filing status and shows average tax - the. One of the best things about being a nanny for a nanny share is that nannies typically make more money. The process should look something like this.

Verify If You Owe Nanny Taxes. And if you need a sample nanny contract or access to tax forms before your nanny begins working we have these free. The Nanny Tax Company has moved.

If you paid your nanny 2200 or more in 2020 then you and your employee owe FICA taxes. This is the contribution to your employees Social. This calculator assumes that you pay the nanny for the full year.

The amount of qualifying expenses increases from 3000 to 8000 for one qualifying person and from 6000 to 16000 for two. The Nanny Tax Company has. Multiply the number of hours by the hourly wage.

Good news though NannyPay offers a low-cost and up-to-date software solution for calculating nanny taxes and preparing annual Form W-2s and Schedule H up to 3 employees at no. Use The Nanny Tax Companys hourly nanny tax calculator to calculate nanny pay and withholding. As an employer you are obliged to enrol your employee onto a pension scheme.

The easiest way for you to estimate your nanny tax obligation is to use a nanny tax calculator. NannyPay is secure and cost-effective nanny tax payroll management software for calculating taxes for your nanny babysitter housekeeper personal assistant or any household employee. These rates are the default rates for employers in.

Then print the pay stub right from the calculator. Nanny taxes are the federal and state taxes families pay as well as withhold from a household employee if they earn 2400 or more during the 2022 year. Computation of Nanny Tax.

Your individual results may vary and your results should not be viewed as a. This Income Tax Calculator shows current and past tax brackets and estimates federal tax for years 2000-2012. Our tax payment calculator quickly gives you the data you need to file quarterly and at the end of the year.

It is then the decision of the employee whether they opt in or out of the scheme you cannot choose for. Same rules apply for a nanny share. Easy-to-use nanny tax calculator provides estimate of tax responsibility for a householder employer and tax withholdings for nanny or other domestic worker.

These look something like. Nanny taxes see our detailed guide on what nanny taxes are and if you have to pay them Nanny tax payroll service for calculating taxes and. With a nanny tax calculator you can.

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

3 Ways To Pay Nanny Taxes Wikihow

How To Pay Your Nanny S Taxes Yourself Nanny Tax Payroll Template Nanny Payroll

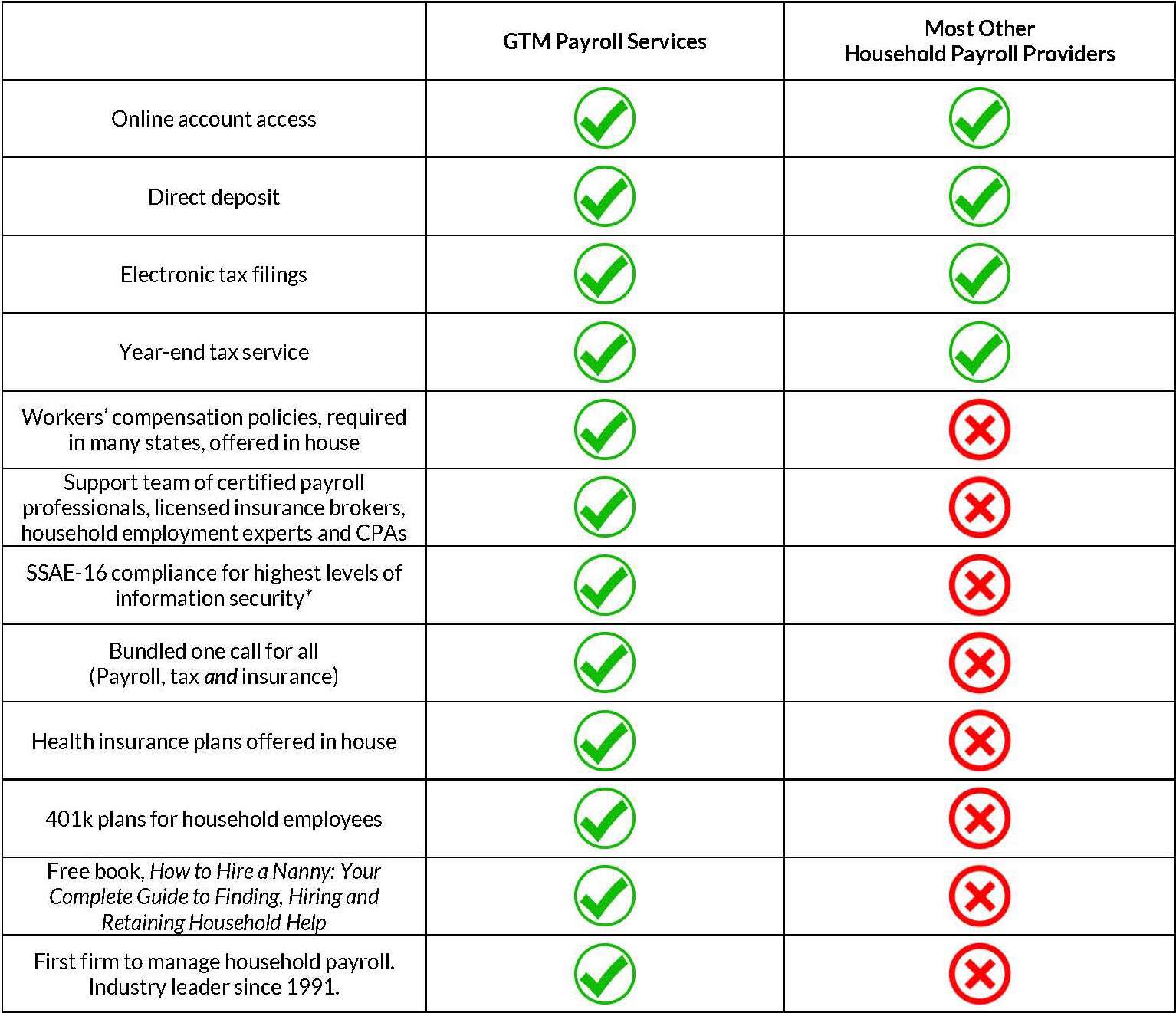

Nanny Tax Calculator Gtm Payroll Services Inc

Prepare Free Nanny Payroll With Our Excel Template Nanny Self Help

Can I Deduct Nanny Expenses On My Tax Return Taxhub

How Much Should I Pay My Nanny Free Nanny Tax Calculator

Babysitter Taxes Should A Nanny Get A 1099 Or W 2 H R Block

The Diy Household Employee Payroll Service Simple Nanny Payroll

Nanny Payroll Service Comparison Gtm Payroll Services

Household Employment Blog Nanny Tax Information Calculate Nanny Payroll Tax

Nanny Tax Payroll Calculator Gtm Payroll Services

5 Answers You Need When Using A Nanny Tax Calculator

Free Payroll Tax Paycheck Calculator Youtube

Nanny Tax Payroll Calculator Gtm Payroll Services

.png?width=800&name=2017%20W-2%20FORM%20(2).png)

W 2 Reporting Required For Nanny Tax Free Healthcare Benefits