what taxes do i pay after retirement

The good news is. Retirees with high amounts of monthly pension income will likely pay taxes on 85 of their Social Security benefits and their total tax rate might run as high as 37.

After Tax 401 K Contributions Retirement Benefits Fidelity

Any amount over 34000 will qualify 85 of your benefits to be taxed.

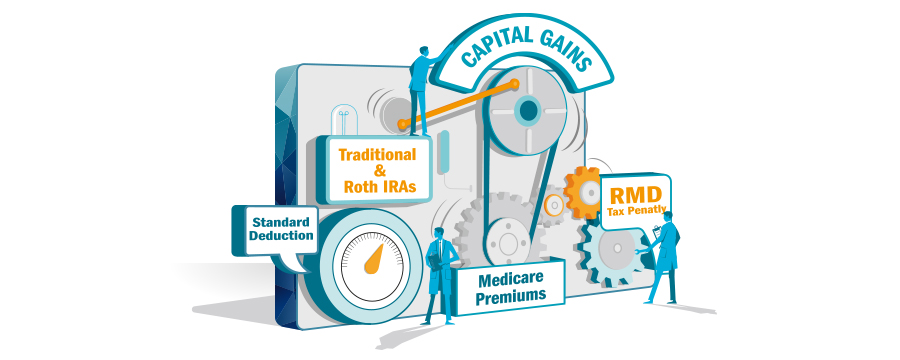

. If its a traditional IRA SEP IRA Simple IRA or SARSEP IRA you will owe taxes. Tax withheld at source Generally taxes are withheld from your pension. If its not you will.

Taxable taxed at your marginal tax rate less a 15 tax offset. If you are married filing jointly 50 will be taxable if your combined income with your spouse is between. Your income payment has two parts.

A single person making between 0 and 9325 the tax rate is 10 of taxable income. That threshold will rise to 19560 a year in 2022. If your private pensions total more than 1073100 You usually pay a tax charge if the total value of your private pensions is more than.

You may also owe extra tax at the end of the tax year. Everyone working in covered employment or self-employment regardless of age or eligibility for benefits must pay Social Security taxes. However income derived from after.

Money deposited in a traditional IRA is treated differently from money in a Roth. If youre age 55 or younger. Tax-free you dont pay anything more.

Yes Youll Still Pay Taxes After Retirement And It Might Be a Big Budget Item The average American pays about 10500 a year in total income taxes federal state and. If you were a member of a pension before 6 April 2006 you may have the right to be paid a tax-free lump sum of more than 25 of the value of your pension under the scheme. To be paid the.

How to pay income tax or other additional tax. During the year you reach full retirement age the SSA will withhold 1 for every 3 you. What taxes do you pay after retirement.

If you file for Social Security benefits before your full retirement age but keep working the Social Security Administration will temporarily reduce your benefit payments. Of course if you get a paying job after retirement Social Security and Medicare taxes will be deducted from your paycheck. However the tax burden youll incur varies by the type of account you have.

For most people and with most 401 ks distributions are taxed as ordinary income. There are several ways to pay your income tax or other additional tax. For a single person making between 9325 and 37950 its 15.

States that Dont Tax Income from 401 ks IRAs or the TSP. Both your income from these retirement plans and your earned income are taxed as ordinary income at rates from 10 to 37. You can usually only.

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401ks 403bs and similar retirement plans and tax. However there are narrow exceptions to. In my experience your contributions are typically about 2-5 of your annual retirement income for FERS and about 5-10 for CSRS.

Once you turn 65 you may be able to claim a larger. This means that about 90-98 of your. While plan administrators generally deduct 10 percent from 401 k distributions for taxes if you have more than one source of retirement income you could still owe money when you file your.

In 2021 the threshold was 18960 a year. Tax-advantaged retirement savings plans401 k IRAs and the Thrift Savings Plan TSPprovide the lions.

Can I Afford To Retire Arizona State Retirement System

Retirement Planning With Taxes

Roth Ira Rules Contribution Limits And How To Get Started The Motley Fool

Tax Planning For Retirement Ameriprise Financial

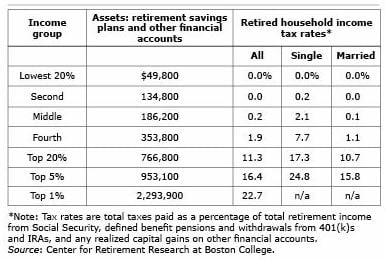

Who Should Make After Tax 401 K Contributions Smartasset

How Can I Get My 401 K Money Without Paying Taxes

How Much Of Your Fers Pension You Ll Keep Plan Your Federal Benefits

How Much Tax Will I Pay In Retirement Fifth Third Bank

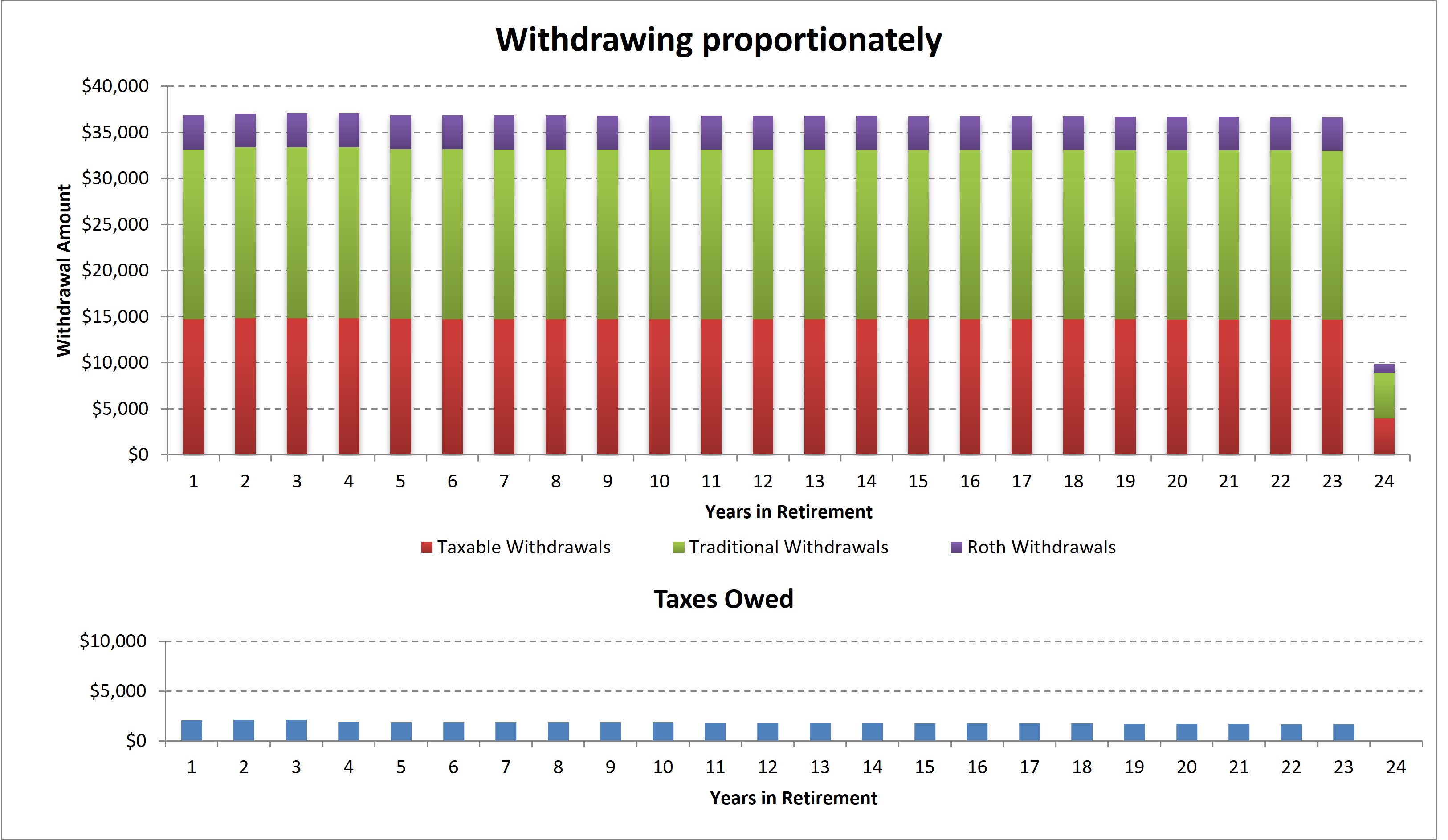

Savvy Tax Withdrawals Fidelity

Taxes On Social Security Benefits Kiplinger

:max_bytes(150000):strip_icc()/salaries-and-benefits-of-congress-members-3322282-v3-5b5624da46e0fb0037e1976a.png)

Salaries And Benefits Of Us Congress Members

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable At Age 62

Taxes Colas And Working After Retirement Missouri Lagers

Taxes On 401k Distribution H R Block

Why Most Elderly Pay No Federal Tax Squared Away Blog

Will Your Planned Retirement Income Be Enough After Taxes Brady Martz Associates

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay